nj property tax relief homestead benefit

New Jersey Governor Murphy froze the May 1 2020 Homestead Benefit Program payment in the midst of the COVID-19 pandemic and. What Is Nj Homestead Benefit.

Property Tax Relief Programs West Amwell Nj

Phil Murphy announced Thursday his administration will extend property tax relief to about 18 million New Jersey households by replacing the states Homestead Benefit program.

. Those older than 65 or who are. The 2020 property taxes due on your home must have been paid by June 1 2021 and the 2021 property taxes must be paid by June 1 2022. When Homestead benefits went wrong.

Because the benefit is no longer handled as a rebate it is no longer accounted for on your federal or NJ tax returns. You can file for a Homestead Benefit regardless of your income but if it is more than the amounts above we will deny your application. Or 75000 for homeowners under 65 and not blind or disabled.

The ANCHOR program expands on and replaces the Homestead Rebate Program which serves 470000 homeowners annually and provides an average benefit of 626. Taxation University 609-633-6015. Under Murphys plan homeowners making up to 250000 annually would qualify for direct property-tax relief benefits averaging roughly 680.

That would add at least 100000 to the current income cutoffs for direct property-tax relief benefits. Currently the average property tax benefit is 626 with eligibility limited to homeowners making 75000 or less if theyre under 65 and not blind or disabled. New Jerseys Property Tax Relief Programs Joyce Olshansky Team Leader.

Renters are not eligible for the current Homestead program but ANCHOR recognizes that rents are often raised to offset rising property taxes. The 2016 income requirements were that you had to earn less than 150000 for homeowners who are age 65 or. Property Tax Relief Programs Homestead Benefit.

Condominium units and units in co-ops or continuing care retirement communities are not considered multiunit properties. When you report your property taxes paid you already account for this benefit. Under a proposal Murphy unveiled Thursday New Jersey homeowners making up to 250000 annually would be eligible to receive state-funded property-tax relief benefits.

The information on the property tax relief program is based on the tax year. 150000 for homeowners 65 or older or blind or disabled. Most homeowners receive a benefit in the form of a credit which reduces their property taxes.

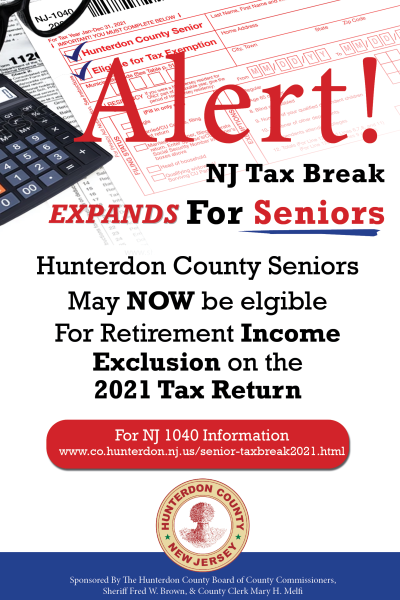

The New Jersey Homestead Benefit Program provides property tax relief to eligible homeowners in the form of a property tax credit that the state pays to municipalities on behalf of eligible homeowners to reduce their tax liability. And over the past five years the average New Jersey property-tax bill has increased by 563 easily swamping todays average Homestead benefits which are 526 for senior and disabled recipients and 412 for all other recipients according to the budget documents. The plan is to replace the Homestead Rebate with a new initiative called ANCHOR or the Affordable New Jersey Communities for Homeowners and Renters program.

The Best Explanation Property tax relief to eligible homeowners is provided by the homestead benefit program. Since you occupy only one-fourth 25 of the property we calculate your benefit using 25 of the property taxes. The current Homestead program funds direct benefits that total closer to 630 with those benefits only provided to senior and disabled homeowners earning up 150000 annually and all other homeowners earning up to.

The NJ Homestead Benefit reduces the taxes that you are billed. For New Jersey homeowners making up to. Homestead Benefit 1-888-238-1233 Property Tax Reimbursement 1-800-882-6597.

The ANCHOR program would replace and expand the states Homestead rebate for seniors people with disabilities and low-income homeowners. Your total annual income combined if married or civil. There is no partial year credit if you were not living in the home as of Oct.

That program shortchanged for years reaches 470000.

Governor Visits Fair Lawn Announces Tax Relief Program Fair Lawn Glen Rock Nj News Tapinto

How Effective Are Property Tax Relief Initiatives Nj Spotlight News

Murphy Proposes New Direct Property Tax Relief Program New Jersey Monitor

Nj Property Tax Relief Program Updates Access Wealth

Senior Freeze Homestead Benefit Programs River Vale Nj

Florida Property Tax H R Block

No Cell Phones Sign Printable Elegant Schedule Template Project Diary Excel Journ Business Plan Template Free Rental Agreement Templates Business Plan Template

1 8m Eligible For Proposed Nj Property Tax Relief Program Murphy Across New Jersey Nj Patch

New Jersey Governor Phil Murphy Unveils Anchor Property Tax Relief Program Abc7 New York

Nj Property Tax Relief Program Updates Access Wealth

Property Tax Relief Programs West Amwell Nj

Jon On Instagram Weekly Client Review Spotlight I Love Real Estate If You Have Any Questions Drop Them Below Real Being A Landlord Knowledge Real Estate

Nj Homestead Rebate What To Know Credit Karma Tax

Can Your N J Property Taxes Actually Be Reduced We May Soon Find Out Nj Com

New Jersey Voters 50 Need More Property Tax Relief

Nj Governor Unveils Anchor Property Tax Relief Program Morristown Nj News Tapinto

Gov Murphy Unveils Anchor Property Tax Relief Program Whyy

Governor Phil Murphy Tax Relief Is A Critical Component Of A Stronger And Fairer New Jersey With Middle Class Tax Rebates An Expansion Of Our Earned Income Tax Credit The Long Overdue Updating