german tax calculator for foreigners

57918 EUR - 274612 EUR. When you file a tax declaration you find your real income tax.

Marginal Tax Rate Formula Definition Investinganswers

274612 EUR and above.

. However if he would give to each of his 2 children EUR 400000 and the remainder 500000 to his wife no beneficiary would pay any German inheritance tax. The beneficiaries of the inheritance are taxed according to their taxable class. Financial Facts About Germany.

However tax is only paid on the amount that exceeds the non-taxable minimum of 9744 per year for a single person or 18816 per year for a married couple. Real estate capital gains are only taxed if the property was not occupied by the owner and was held for under 10 years. You own a commercially registered business in Germany.

Dividend Tax Austria. Foreign dividend investors are typically eligible to reclaim a 125 refund according to their double taxation treaty. Germany is not considered expensive compared to other European countries the prices of food and housing.

The tax is calculated over their net inheritance which is the amount that is left over after any allowances and exemptions have been taken off. In addition the solidarity surcharge and if applicable church tax are levied. As of January 2021 this tax is not paid by individuals with an average salary of around 62000 EUR or below.

German Income Tax Return and Social Security Refund services especially for foreigners currentlypreviously working in Germany. Income tax Einkommensteuer Lohnsteuer on wages in Germany ranges from 14 to 45. Gross Net Calculator 2022 of the German Wage Tax System.

A 55 solidarity surcharge is imposed on the income tax liability of all taxpayers. Its missing many important tax deductions. Our motive is to provide you with income tax advisory services which.

The current dividend tax rate in Austria is 275. Everyone can earn foreign income from different types of income. This is the percentage of the tax rate in every class.

The calculator will produce a full income tax calculation simply by. An employee with an yearly income of 9744 wont have to pay income tax for married employees the limitation will be 19488. 1 Income Tax Act are subject to income tax.

Youll be required to pay trade tax if the following apply to you. The rate of 42 the so-called Spitzensteuersatz in Germany applies to a taxable income above 57052 to 270500 for individuals. If he leaves everything to his wife his wife must pay German inheritance tax on an amount of 800000 a rate of 19.

It starts at 1 and rises incrementally to 45. Value of personal inheritanceUp to amount EUR Class lIn. Most people get a bit of money back because their real income tax is lower than the salary tax they paid.

The German tax system can be pretty complicated as the German tax system is progressive. Income from agriculture and forestry. The German Annual Income Tax Calculator for the 2022 tax year is designed to provide you with a salary payroll and wage illustration with calculations to show how much income tax you will pay in 202223 and your net pay the amount of money you take home after deductions.

A of the EStG 1988. If you are an employee this calculator only shows your salary tax. If a German tax resident is a member of a church entitled to impose church tax church tax is assessed at a rate of 8 or 9 on income tax liability depending on the location.

On top of these headline rates of tax depending on your income you may also pay a solidarity surcharge Solidaritätszuschlag. You can reclaim your Austrian dividend tax via this form which is according to 27 II 1 lit. The rate for trade tax is between 7 and 175 and its included in your quarterly pre-payments and submitted for the final tax report Steuererklärung.

Realized capital gains interest and dividends are subject to a 25 percent final withholding tax. There is not a wealth tax in Germany but inheritance tax varies from 7 to 50 based on the value of the inheritance. Rental income taxes are due to the country where the rental is located.

Salary tax is an estimation of your income tax. 34d Income Tax Act of the German tax law determines how these are taxed Any deductions are therefore determined by the Income Tax Act Einkommensteuergesetz. These figures place Germany on the 12th place in the list of European countries by average wage.

National income tax rates for individuals. You earn more than 24500 per year. Good to know before you fill in the salary calculator Germany.

The average monthly net salary in Germany is around 2 400 EUR with a minimum income of 1 100 EUR per month. Payroll taxes and levies in Germany. With the flat rate tax calculator from depotkontode you can easily calculate the amount of the flat rate tax free of charge.

According to 2 para. Solidarity tax Solidaritätszuschlag is 55 of the income tax. Investment income is tax-free in an.

How To Estimate Your Taxes To Extend Filing Deadline Forbes Advisor

Personal Income Tax Solution For Expatriates Mercer

Income Tax In Germany For Expat Employees Expatica

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Payroll And Tax In Ireland Tax Services Payroll Payroll Taxes

New York State Enacts Tax Increases In Budget Grant Thornton

How Is Taxable Income Calculated How To Calculate Tax Liability

Taxes For Expats How To File Your Us Taxes From Abroad Working Mom Life Working Moms Expat

Where Do Your Taxes Really Go Infographic

How To Calculate Payroll Taxes Insurance Noon Payroll Taxes Payroll Tax

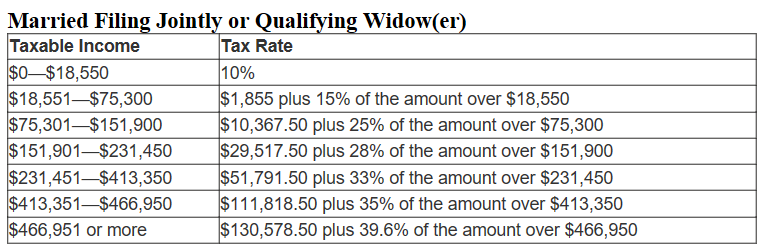

What Is My Tax Bracket 2021 2022 Federal Tax Brackets Forbes Advisor

How To Calculate Foreigner S Income Tax In China China Admissions

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Definition Of The Statutory Tax Rate Higher Rock Education

Excel Formula Income Tax Bracket Calculation Exceljet

How To Charge Your Customers The Correct Sales Tax Rates

How To Calculate Foreigner S Income Tax In China China Admissions

Best Payroll And Tax Services In Netherlands Payroll Financial Tax Services