philadelphia property tax rate 2022

Counties in Pennsylvania collect an average of. The budgettax rate-determining process usually includes customary public hearings to discuss tax concerns and related budgetary considerations.

Sales Taxes In The United States Wikipedia

The new rate will apply to all applicable unearned income received in Tax Year 2022 January.

. The median property tax in Philadelphia County Pennsylvania is 1236 per year for a home worth the median value of 135200. On Monday Philadelphia officials released the first property reassessments in three years and many property owners are in for a surprise. Below the county level nearly all local public entities have arranged for their county to assess and.

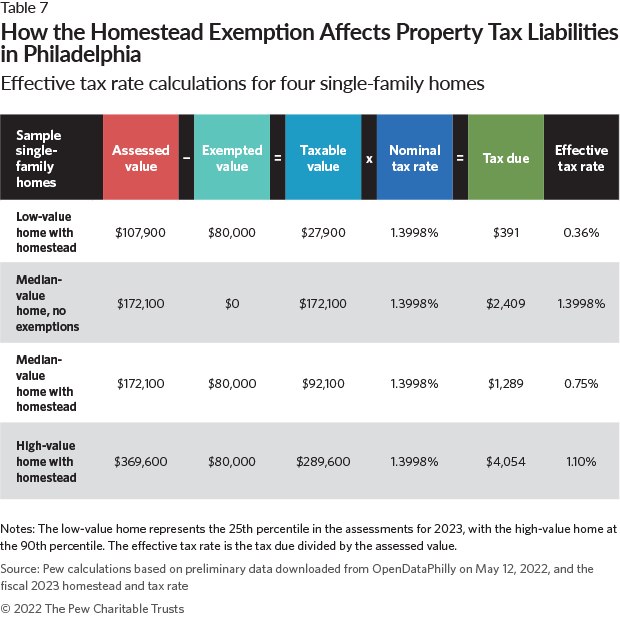

Tax amount varies by county. 06317 City 07681 School District 13998 Total The amount of Real Estate Tax you owe is determined by the value of your. Use the Property App to get information about a propertys ownership sales history value and physical characteristics.

The City of Philadelphia has announced that due to operational concerns caused by the COVID-19 pandemic it will forego a citywide reassessment of all property values for tax year 2022. All of them separately establish what tax rate is required to meet their planned expenses. The average home sales price in Philadelphia went from more than 267000 in 2019 to nearly 311000 as of January according to the multiple listing service Bright MLS.

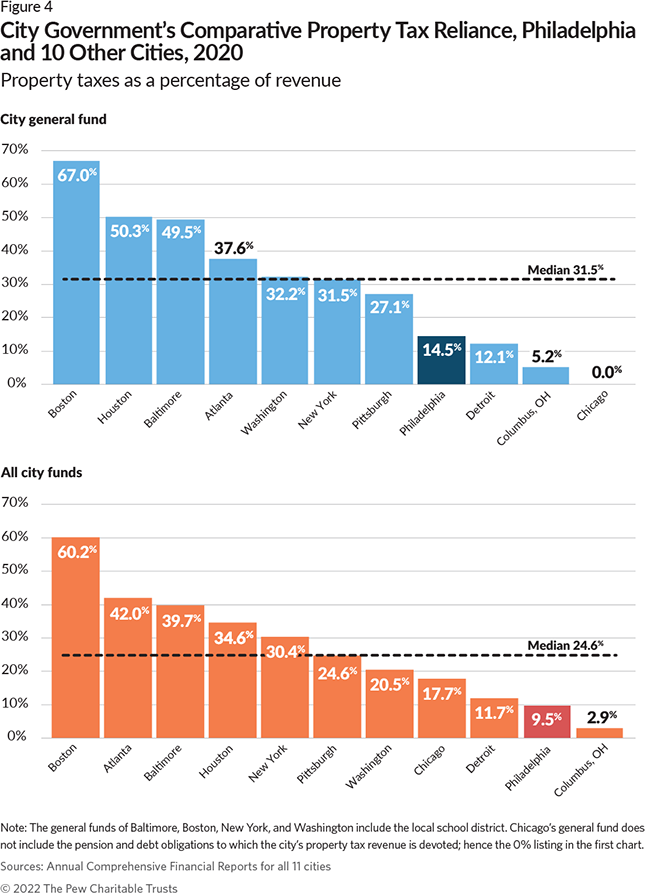

Pew found that residential properties account for 71 of Phillys property tax revenue in 2021 the highest share among comparable cities. The median property tax in Pennsylvania is 222300 per year for a home worth the median value of 16470000. The citys property tax rate is 13998 of the assessed property value.

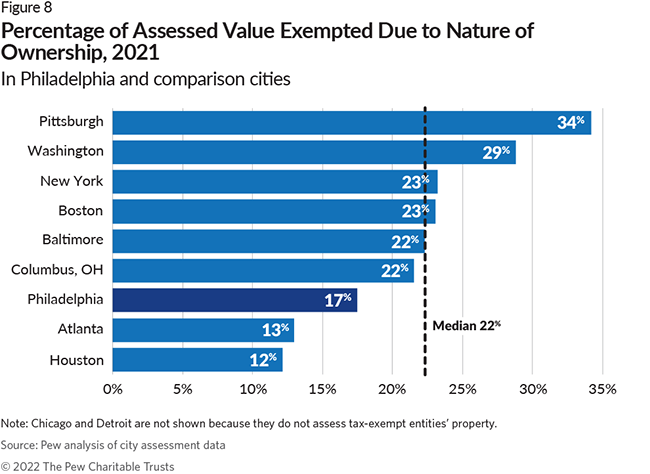

The right side of Figure 6 shows the percentage of real estate tax revenue for all purposes including schools that comes from residential property in each city. Realty Transfer Tax Requirements and rates related to the. Philadelphia County collects on average 091 of a propertys.

By the numbers. For the 2022 tax year the rates are. Find the amount of Real Estate Tax due for a property in the City of Philadelphia and make payments on outstanding balances.

Be aware that under state law taxpayers. In the first citywide reassessment in three years the value of the average residential property in Philadelphia increased a staggering 31 Mayor Jim. You can also generate address listings near a property or within an.

To begin with the property tax process in the city of Philadelphia the first thing we have to do is to access the city government website this can be done in a web browser or by clicking directly.

/cloudfront-us-east-1.images.arcpublishing.com/pmn/VD4HIPK5AZGDFK22JKO657PNAE.jpg)

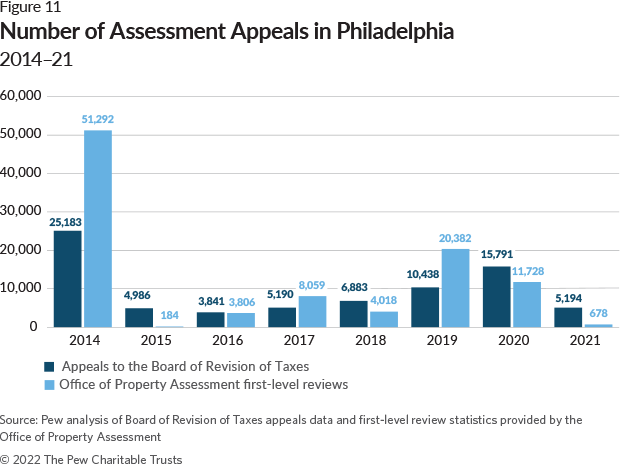

New Philly Property Assessments How To Lower Your Tax Bills Or Appeal

City Skeptical Of Recent Data For Philadelphia Property Taxes

165 000 Philly Homeowners May Be Paying Too Much In Property Taxes Is The City Assessing Property Fairly

Philadelphia On Track For Record Construction Activity In 2022 Philadelphia Yimby

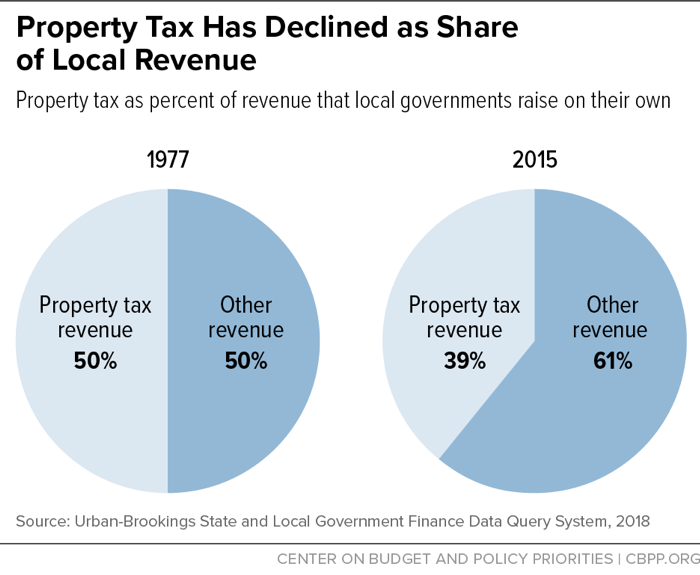

State Limits On Property Taxes Hamstring Local Services And Should Be Relaxed Or Repealed Center On Budget And Policy Priorities

How Property Is Taxed In Philadelphia The Pew Charitable Trusts

How Property Is Taxed In Philadelphia The Pew Charitable Trusts

Pennsylvania Property Tax Calculator Smartasset

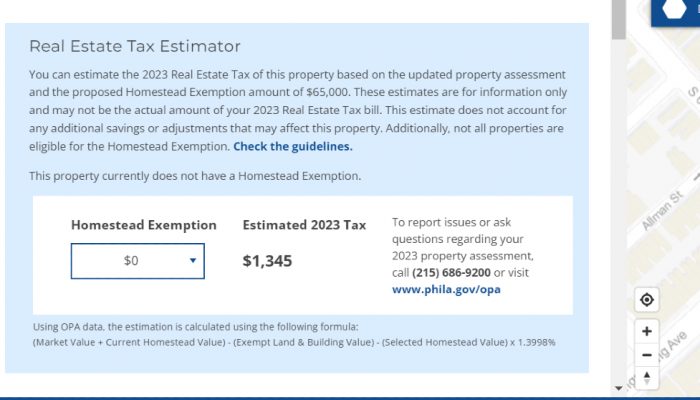

Estimate Your 2023 Property Tax Today Department Of Revenue City Of Philadelphia

Property Taxes Lagged In 2021 Even As Real Estate Prices Soared

The Best Property Management Companies In Philadelphia Pennsylvania Of 2022 Propertymanagement Com

Property Taxes On The Rise South Philly Review

How Property Is Taxed In Philadelphia The Pew Charitable Trusts

City Of New Philadelphia Income Tax Department

How Property Is Taxed In Philadelphia The Pew Charitable Trusts

Pennsylvania Reduces Corporate Income Tax Rate Grant Thornton

Philly Released 2023 Property Assessments Here S How To Calculate Your Property Tax Venture Philly Group

Think Dallas Fort Worth Property Taxes Are High Well You Re Right

Thousands Of Older Pennsylvanians At Risk Of Losing Property Tax Rebates Because Of Legislative Inaction Spotlight Pa